The Only Payment Platform You Need

Simple integration, flexible solutions, and robust security. Experience the next generation of payment solutions with GRANDPAY.

Simple integration, flexible solutions, and robust security. Experience the next generation of payment solutions with GRANDPAY.

Borderless payments and cash management

From deposits to transfers and withdrawals, every payment process is handled smoothly. With support for over 135 currencies, you can conduct transactions across borders with ease. GRANDPAY simplifies complex international financial transactions, ensuring efficient fund transfers for your global business expansion.

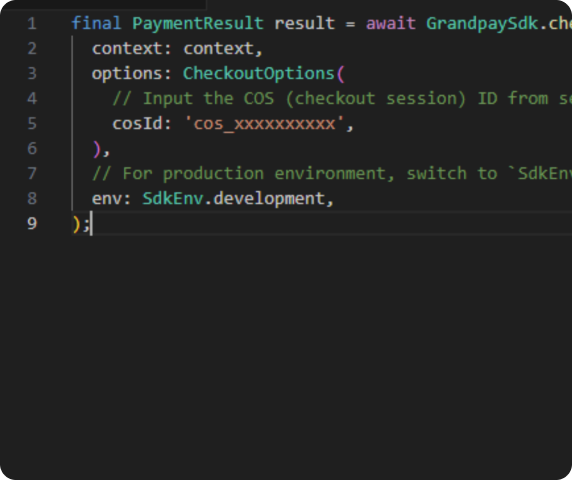

With SDKs for both iOS and Android, implementing payment functions into mobile apps is simple. Integrating wallet and gateway functionalities significantly reduces development time, enabling you to launch services swiftly.

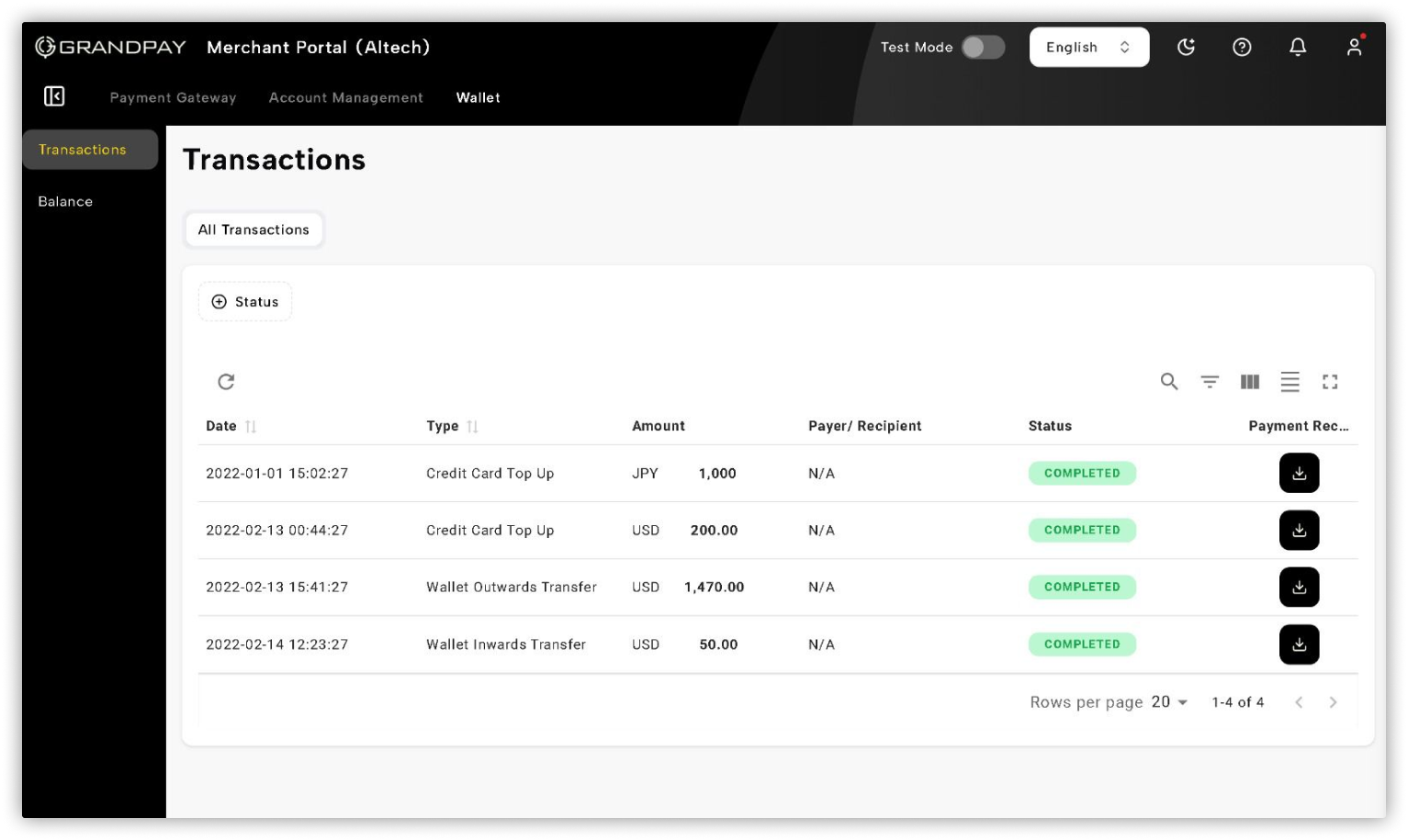

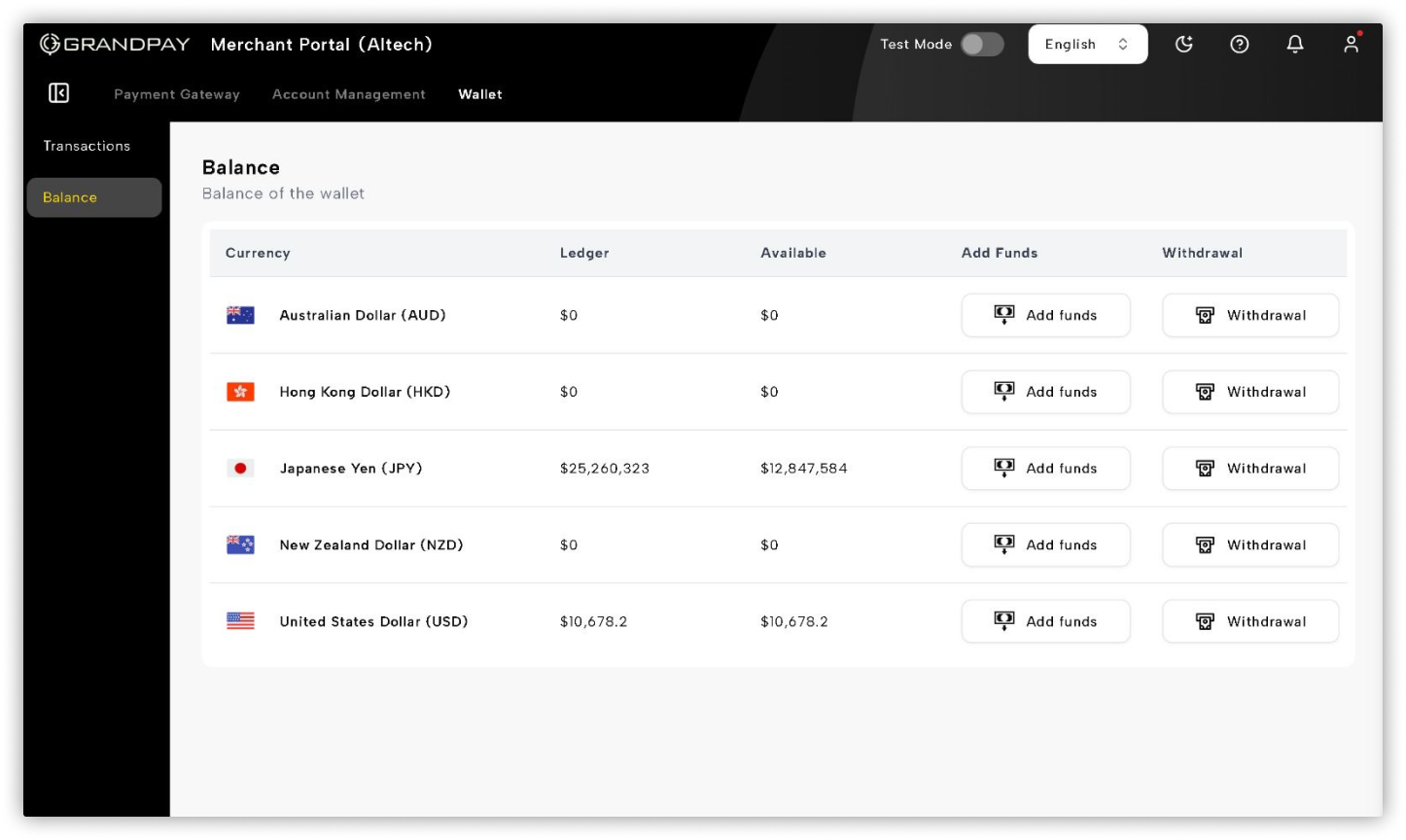

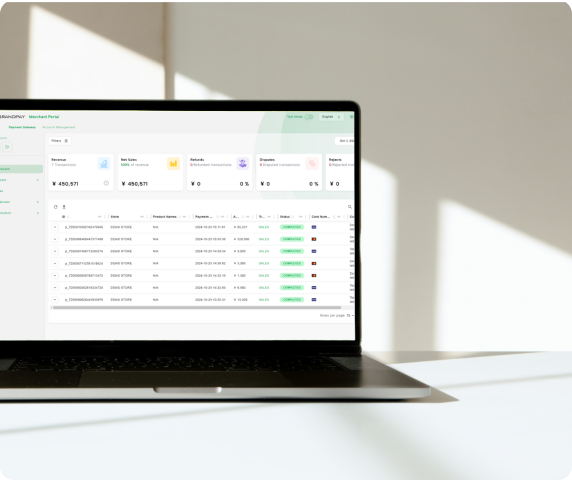

Monitor your financial status in real-time through a dedicated management portal. Manage balances across multiple currencies, review transaction histories, and set up fund transfers—all from a single dashboard. Stay on top of your business’s financial health and make quick decisions with ease.

Process incoming payments from both domestic and international sources quickly and efficiently, optimizing your cash management. Support for multiple major currencies allows you to receive international transfers. Strengthen cash flow management with real-time payment status updates and immediate fund availability. Accelerate global business expansion and enhance international competitiveness.

Support incoming payments in major currencies, including US dollars, euros, and Japanese yen, simplifying complex international payment processes and reducing barriers to cross-border transactions. This enables efficient and swift global business expansion, enhancing your international competitiveness.

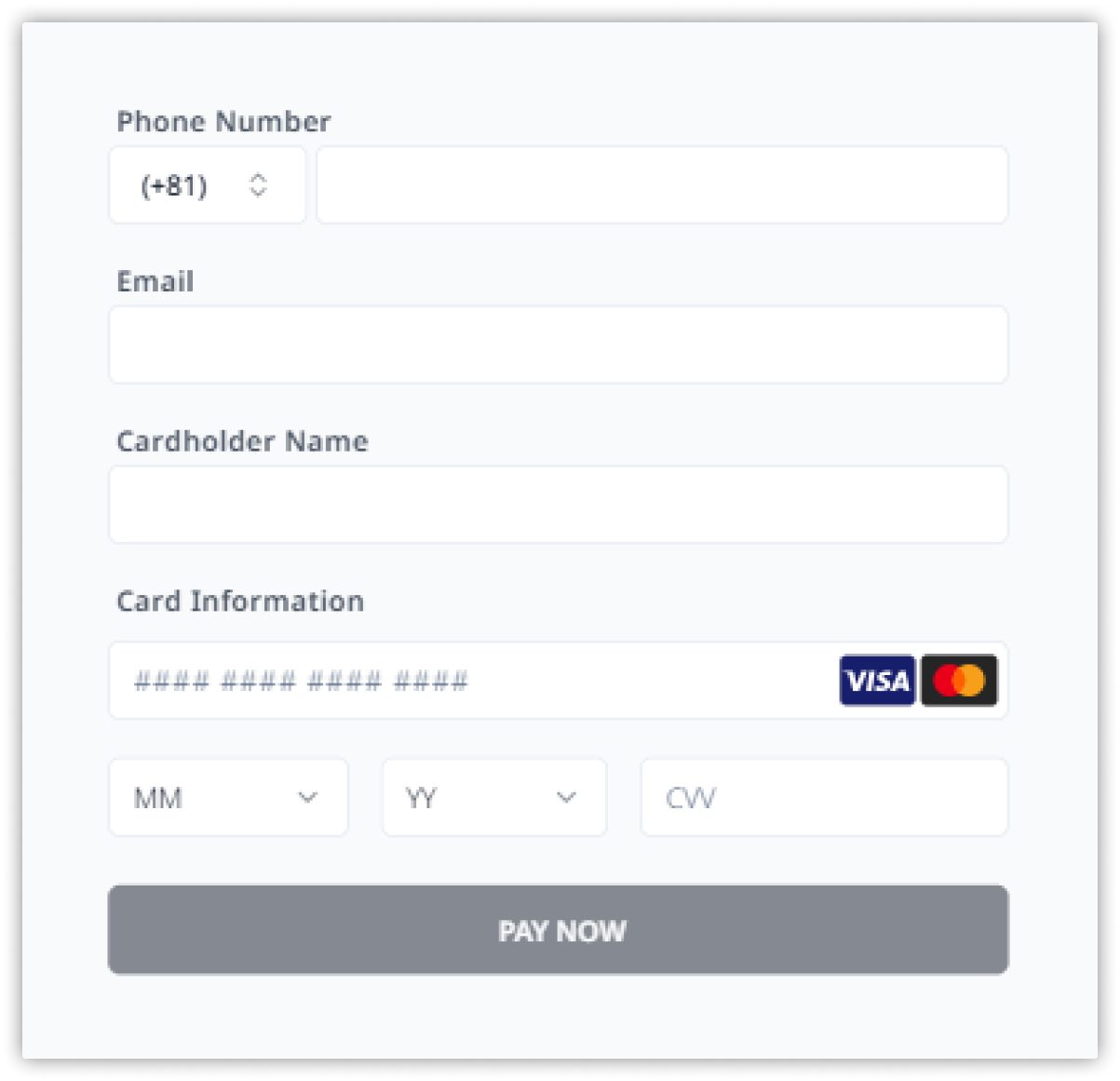

Credit card deposits are processed in real-time and immediately reflected in your account. Supporting major credit card brands such as VISA, Mastercard, and JCB, you can deposit funds anytime, 24/7. It also allows large deposits of up to 5 million yen per transaction, catering to a wide range of business needs.

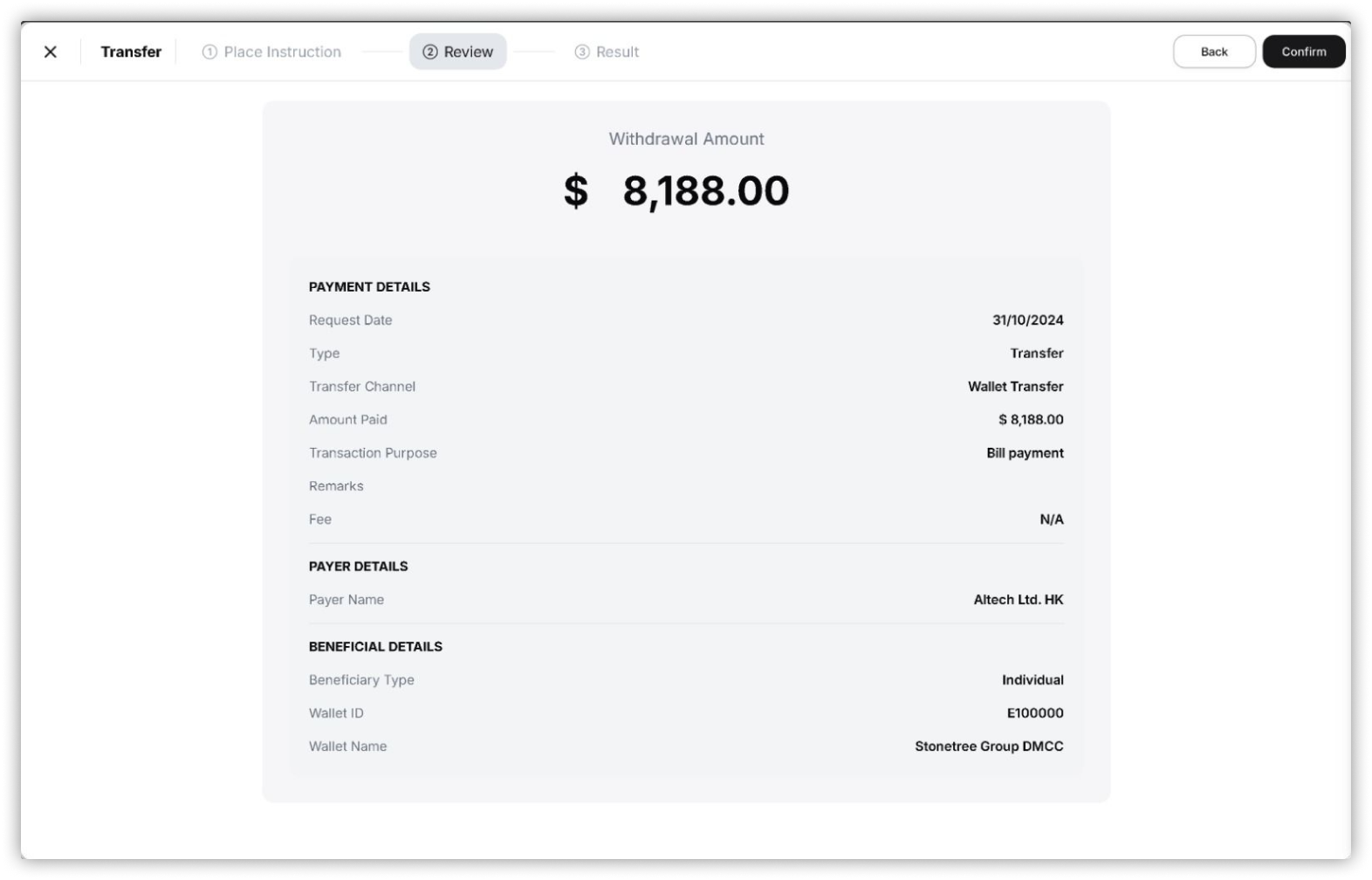

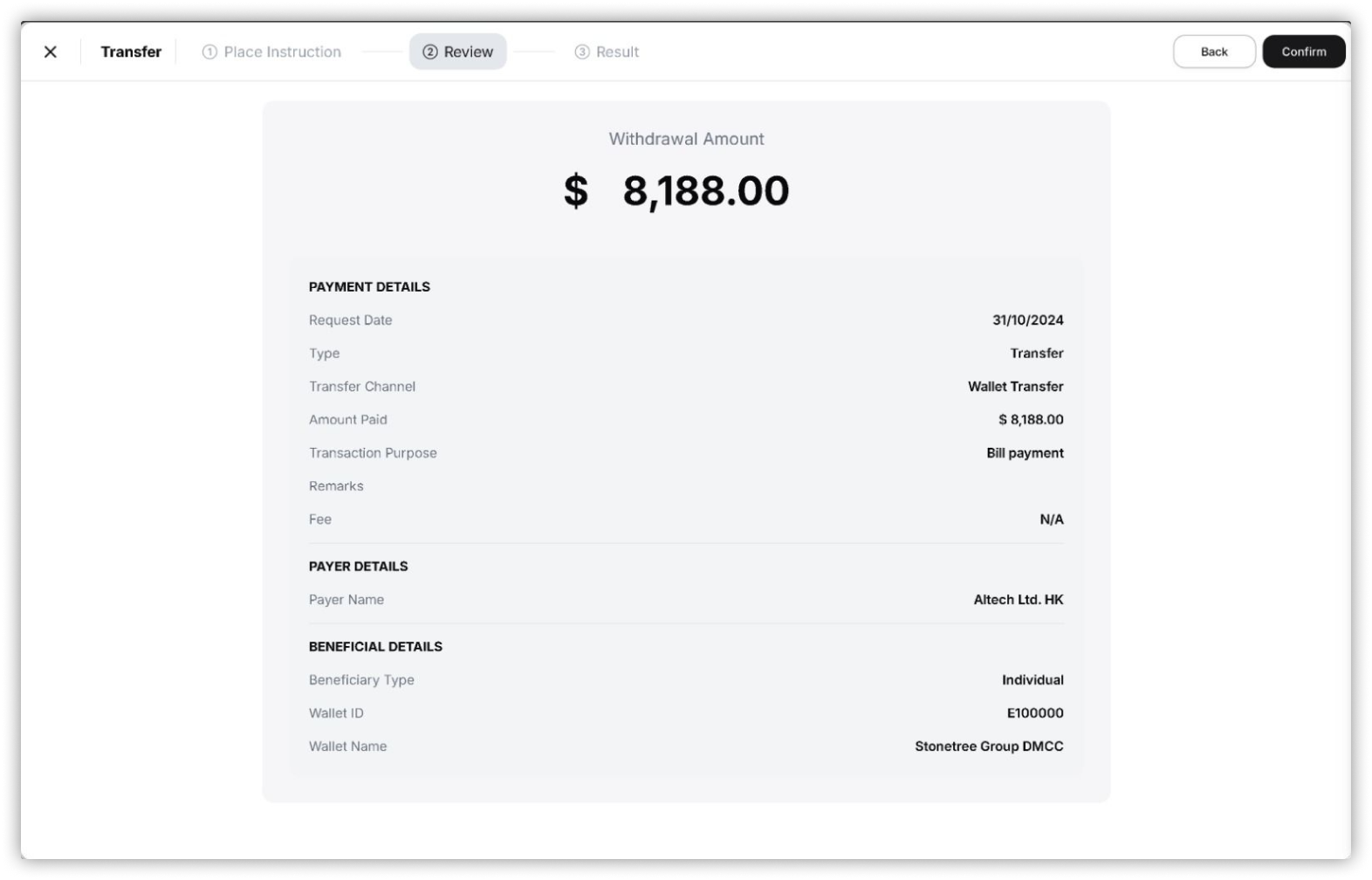

We offer a comprehensive solution that meets the diverse remittance needs of businesses. Achieve significant cost savings in remittances, streamline operational processes, and ensure precise fund flow management, strongly supporting your business growth and international competitiveness.

By using GRANDPAY, you can significantly reduce remittance fees both domestically and internationally. The efficient processing process allows for both cost reduction and quick fund transfer. In addition, the real-time remittance function allows for immediate response to urgent payments. This allows companies to use the saved funds and time to invest in their core business or develop new businesses, accelerating business growth.

With GRANDPAY’s intuitive dashboard, you can centrally manage all your transfer transactions. Real-time transaction monitoring and detailed transfer history provide full visibility into your fund flow, improving cash flow forecasting accuracy and enabling the planning and execution of more strategic financial management.

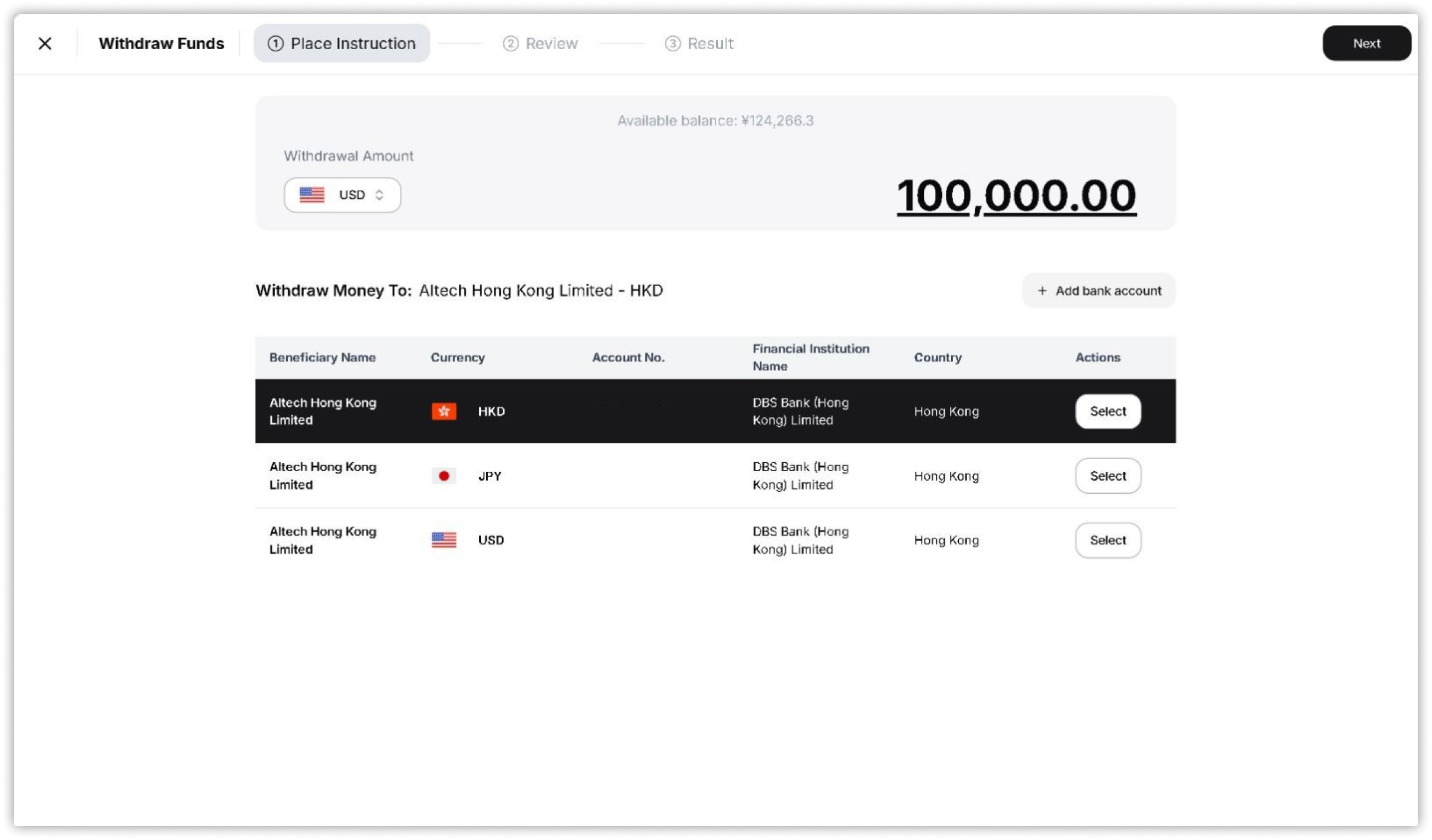

GRANDPAY’s corporate withdrawal feature swiftly addresses diverse funding needs, significantly enhancing business agility. With same-day withdrawal processing and virtual debit card functionality, businesses can access funds instantly and manage expenses flexibly. This supports efficient working capital management and strategic investment decisions, contributing to your competitive edge.

Rapid Fund Access and Maximized Investment Opportunities with Same-Day Withdrawals

Quickly transfer funds to your account with same-day processing, enabling immediate access to working capital. This greatly enhances business agility, allowing you to respond swiftly to market changes and seize unexpected business opportunities, thereby strengthening your competitive advantage in the market.

Flexible Expense Management and Cost Optimization with Virtual Debit Cards

Virtual cards provide flexibility for online transactions and temporary expenses. Set spending limits for each department or project to maintain strict budget control while allowing access to funds as needed. Real-time transaction monitoring makes expense tracking and analysis easy, contributing to cost optimization. With support for international transactions, it also allows efficient management of overseas trips and international service purchases.

*Virtual debit cards are scheduled to be implemented in 2025.

We deeply understand the importance of predictability in corporate financial management. Our structure simplifies financial planning without the need for complex calculations. With tiered pricing based on transaction volume, you can manage costs in line with your business growth.

Learn More →

GRANDPAY is designed with cutting-edge security protocols. It implements strict measures, including real-time threat monitoring, data encryption, and multi-factor authentication, in compliance with international security standards, ensuring robust protection for your company’s assets and transaction information.

A: Opening a corporate account requires submission of a corporate registration certificate, representative's identification, and documents proving the business location.

A: You can deposit funds into your wallet using credit/debit cards, however the deposit limit via credit/debit card is 5,000,000 JPY per card.

A: Transfer fees vary depending on the amount and destination of the transfer. Please check the fees within your wallet.

A: We use the latest global standard security technologies and prioritize data protection at all times. We also adhere to AML policies to prevent fraud and impersonation.

A: dedicated customer support team is available to assist you. Many questions can be resolved by referring to the FAQ page. If you still need help, please feel free to contact customer support.

Utilize an advanced payment platform to streamline and grow your business. Open an account for free and experience intuitive usability and rich features. Our specialized staff is here to provide quick support for customization and specific questions.