STEP1

Create a Corporate Account

STEP2

Register Information

STEP3

Identity Verification

STEP4

Register Bank Account

STEP5

Implement Payment Services

Setting up a GRANDPAY corporate account takes just 5 simple steps. Quickly and smoothly implement the payment solutions your business needs for growth.

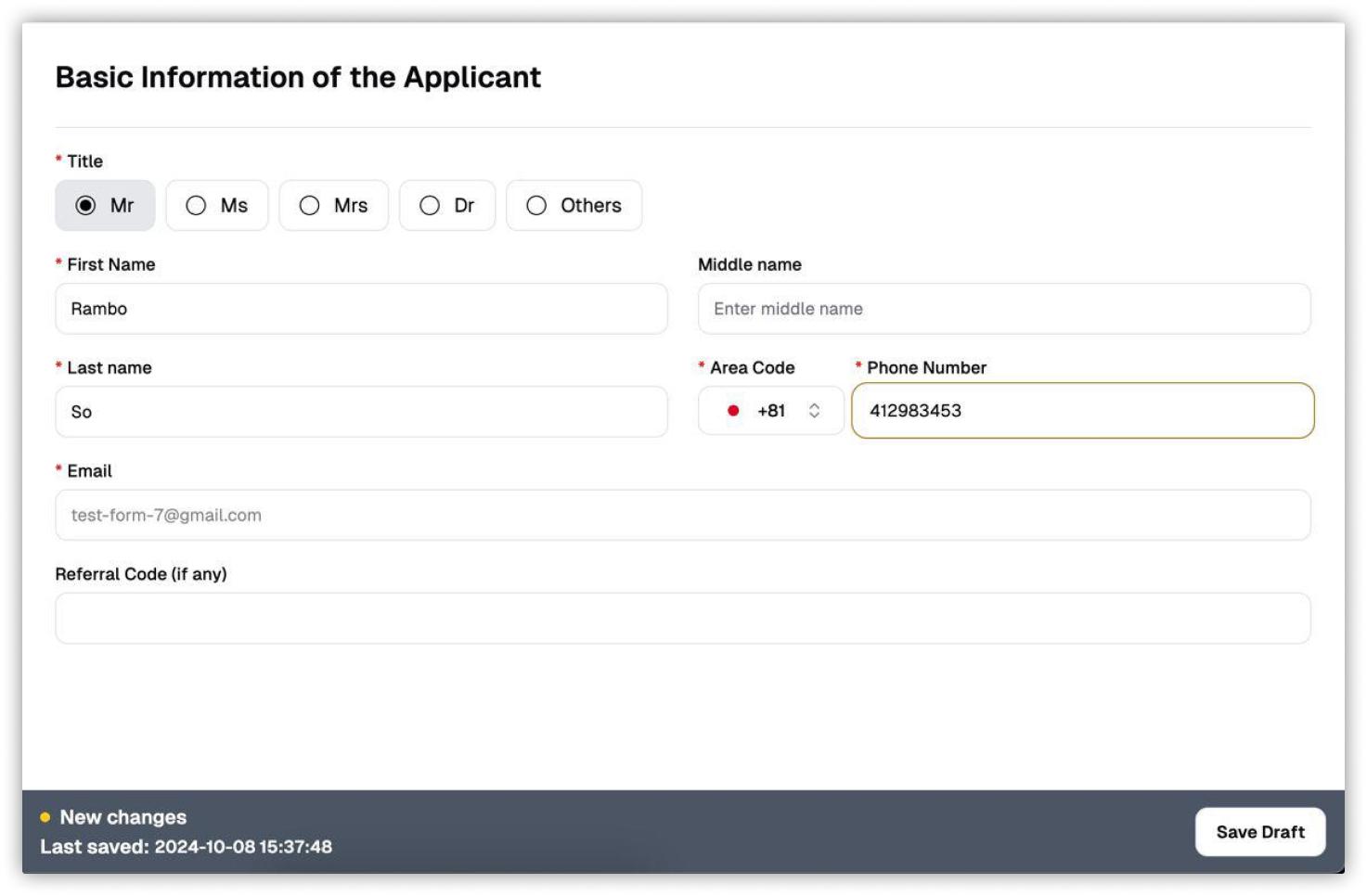

First, please enter basic information such as the name and email address of the person in charge and perform temporary registration.

A verification link will be sent to the email address you entered. Click the link to complete email address verification.

| Q1. What should I do if I do not receive the verification email? | A1. Please first check your spam folder. If it is still not found, wait about 30 minutes and check again. If the email does not arrive, please contact our support center. |

| Q2. Can I register multiple representatives? | A2. Yes, you can register multiple representatives. After opening your account, you can add additional representatives from the management screen. |

| Q3. Can I change the basic information I entered later? | A3. Yes, you can change your basic information from the management screen after opening your account. However, for some important details (such as the company name), additional verification may be required. |

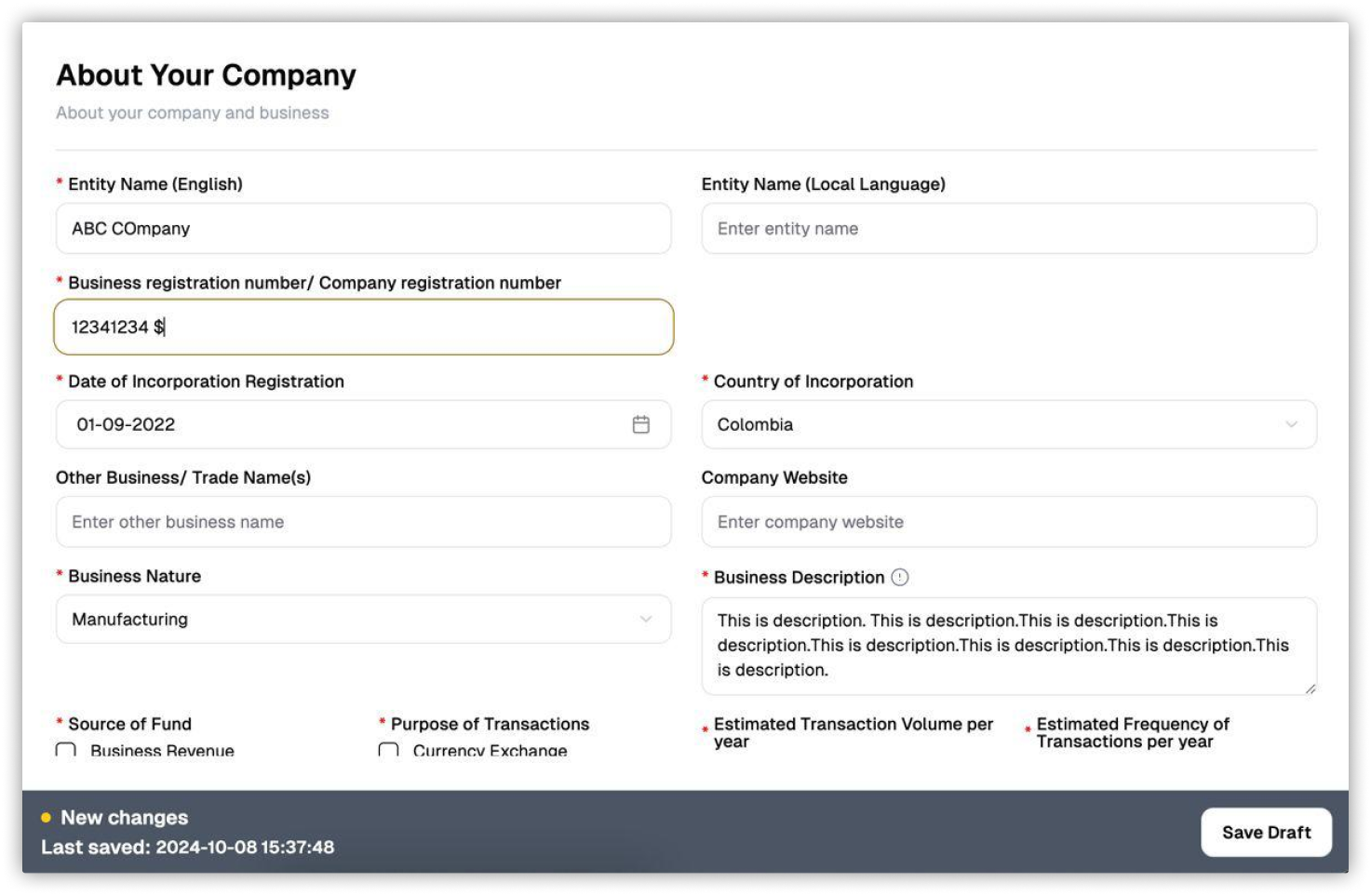

Next, register your corporate information.

Please enter your business details, company address, etc.

In order to verify your corporate information, you will need to upload documents such as a copy of your company register. Please prepare these documents in advance when applying.

| Q1. Can sole proprietors register? | A1. Yes, sole proprietors can register. Please select "Sole Proprietor" as your business type. |

| Q2. What should I do if none of the business activity options apply to me? | A2. Please select the closest option and provide specific details in the "Other" section. |

| Q3. Which address should I enter if my registered headquarters and actual office are different? | A3. As a general rule, please enter the registered headquarters address. You can provide the actual office address as additional information. |

Personal identification of corporate representatives will be conducted using eKYC.

For identification purposes, corporate representatives will need their drivers license or passport. Please have these documents ready in advance.

Select Document

Please select an identification document such as a driver’s license or passport.

Upload Document

Capture and upload the selected document using your smartphone or camera.

Facial Recognition

Take a photo of your face with the camera for facial recognition. This will verify that it matches the document.

| Q1. What types of documents can be used for identity verification? | A1. You can use a driver’s license, passport, My Number Card (front side only), or a residence card (for foreign nationals). |

| Q2. What should I do if facial recognition does not work properly? | A2. Please try again in a well-lit area, making sure your entire face is within the frame. If the issue persists, please contact the support center. |

| Q3. Can an authorized representative perform identity verification instead of the company’s representative? | A3. For opening a corporate account, identity verification by the company’s representative is required. |

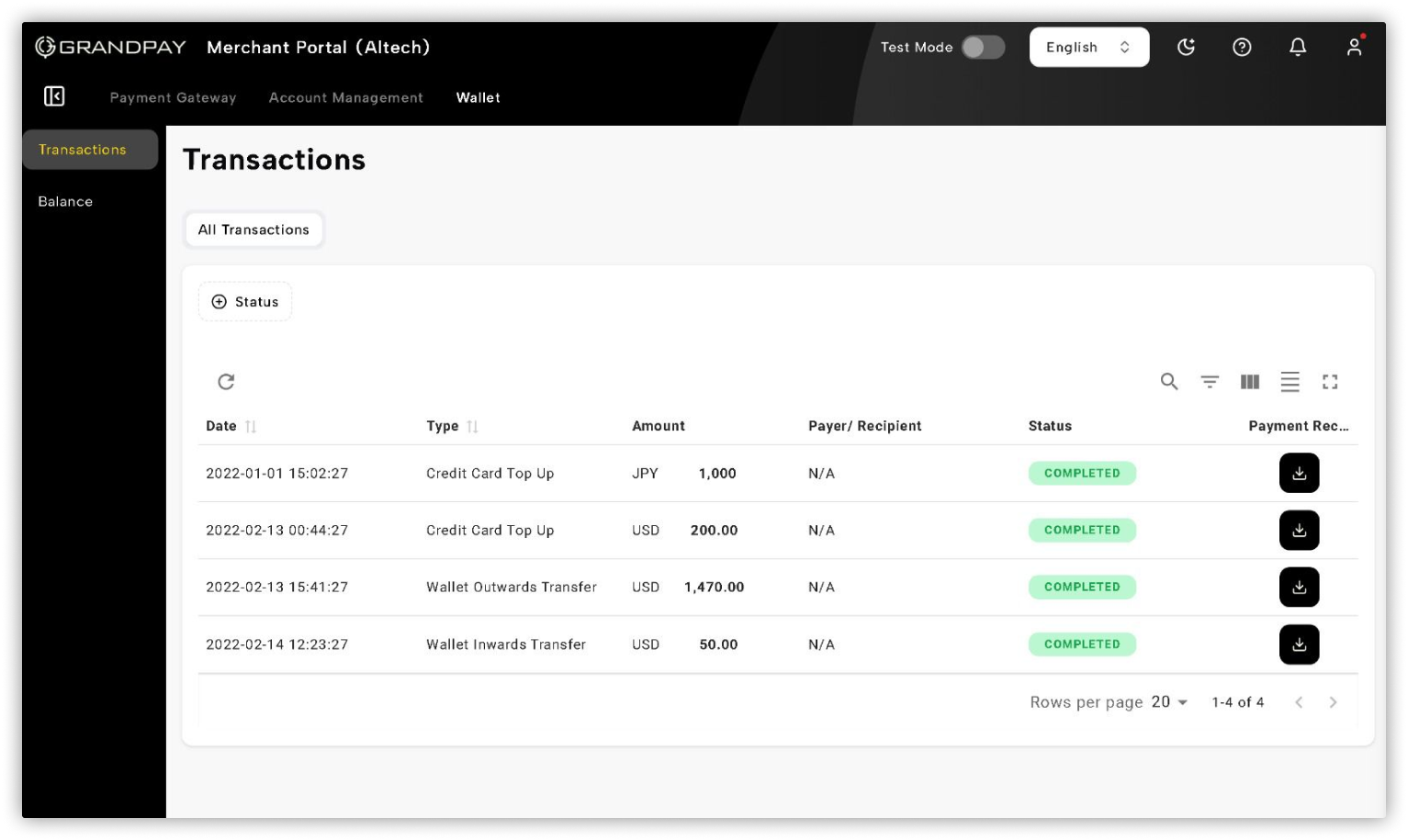

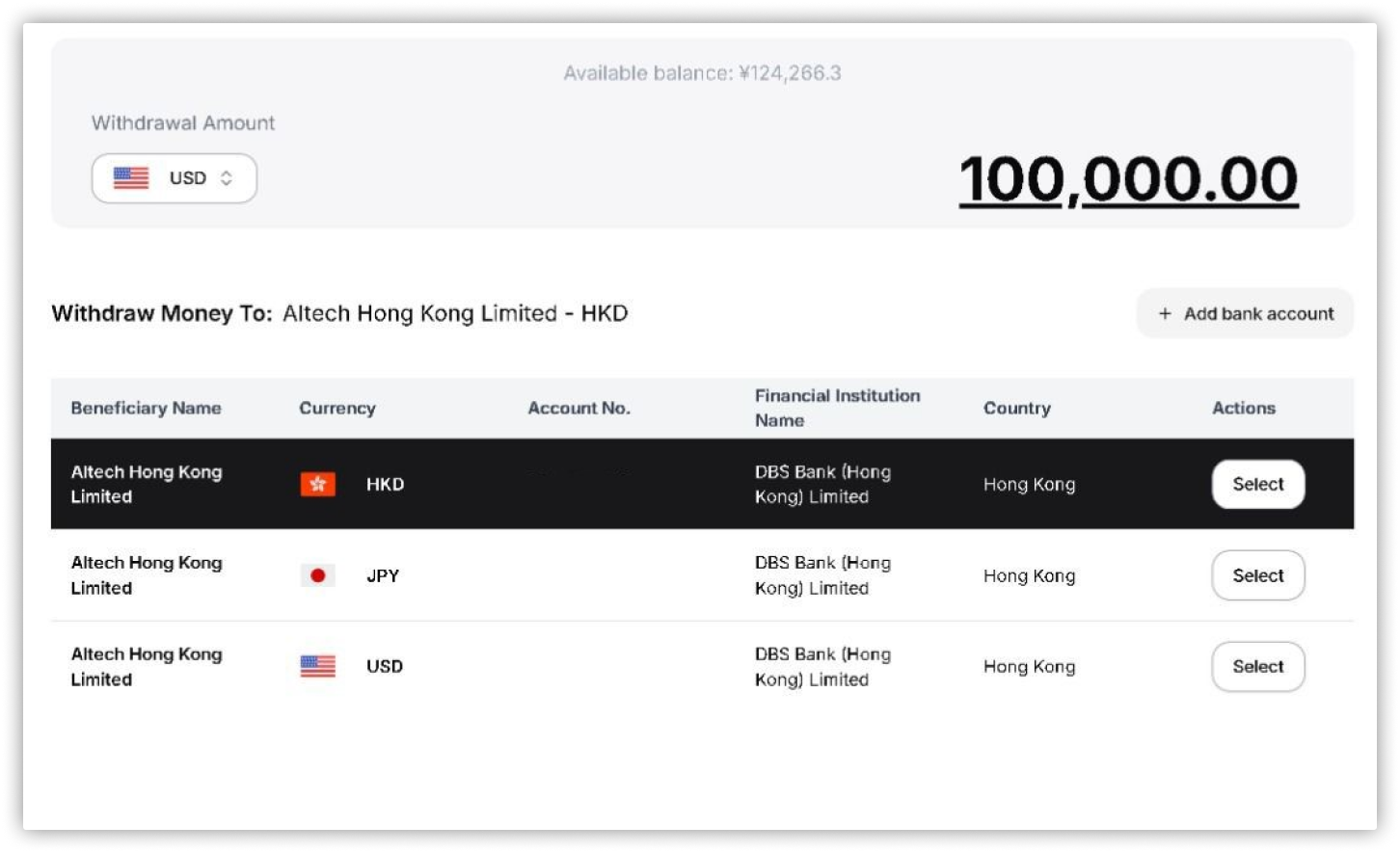

Register your bank account to manage business revenue. Please enter accurate information to ensure smooth deposit and payment processes.

Register accurate bank account information to manage business revenue.

*Note:

The account name must be in the name of the corporation. Personal accounts cannot be used.

| Q1. Can I register only one bank account, or can I register multiple accounts? | A1. Initially, you can register only one bank account. Additional accounts can be registered through the management screen after opening an account. |

| Q2. Can I register a foreign bank account? | A2. Yes, you can register a foreign bank account. However, some banks in certain countries or regions may not be supported. |

| Q3. If I mistakenly register incorrect account information, can I correct it later? | A3. Yes, you can correct it through the management screen after opening an account. However, for security reasons, additional verification may be required for changes. |

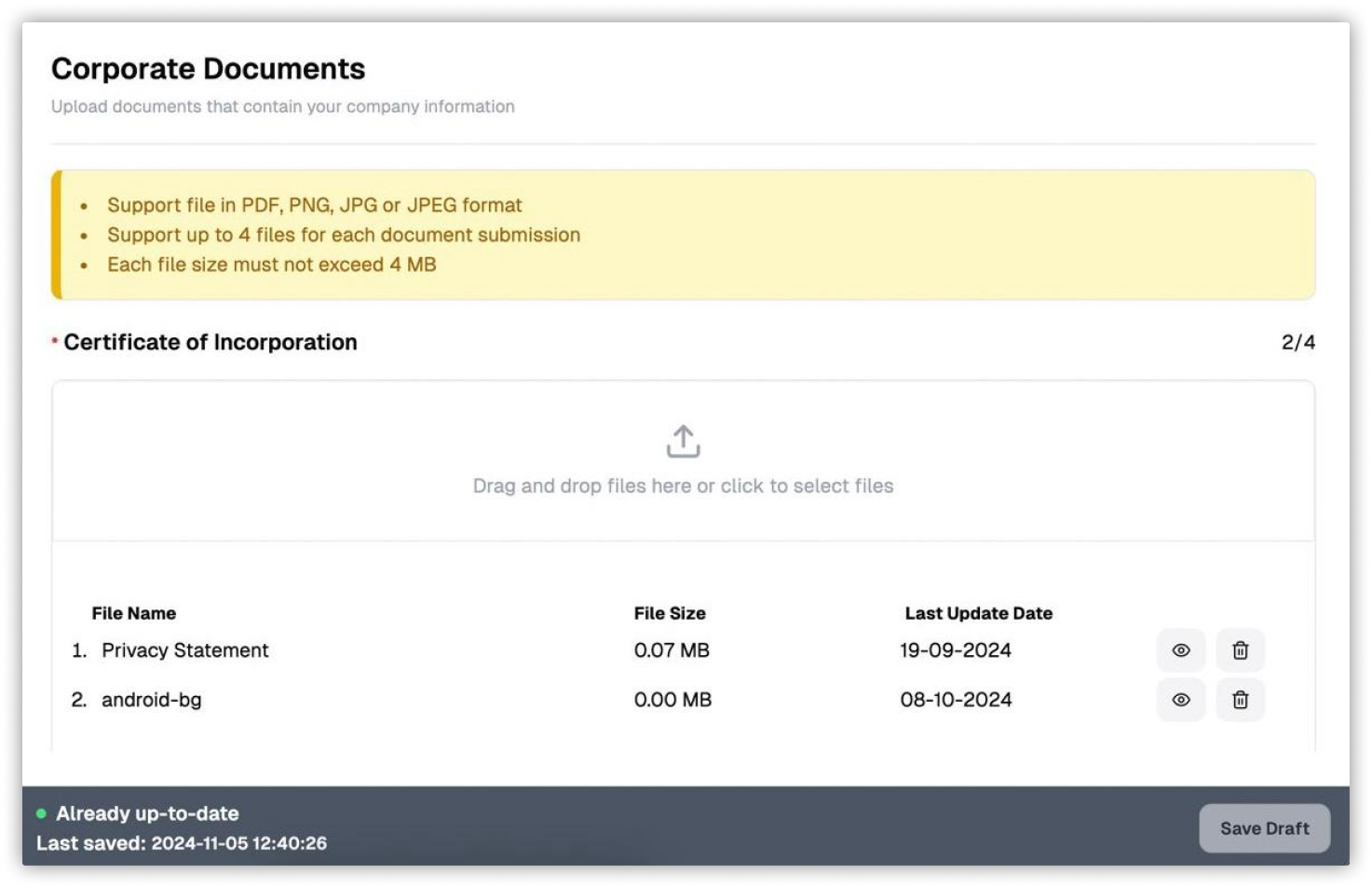

Finally, submit your application to use the GRANDPAY payment service. Please note that a review is required to use the service.

Follow the steps below to complete your application.

Fill out the necessary information in the payment service application form.

Upload the required documents for review (such as business plans, financial statements, etc.).

Review your application details and click the submit button.

The review result will be sent to your registered email address as soon as the next day.

| Q1. How long does the review process take? | A1. The review process usually takes about 2–10 business days. However, if additional verification is required, it may take longer. |

| Q2. What documents are required for the review? | A2. The main required documents are as follows: ・Corporate registration certificate (issued within the last 3 months) ・Recent financial statements ・Detailed information or URL of the products and services Specific required documents can be confirmed in the application form. |

| Q3. Can I start using the service immediately after passing the review? | A3. After passing the review, you can usually start using the service within 1–2 business days. However, if system configuration is required, it may take a bit longer. |

If you have any questions, please feel free to contact us at any time.

Our specialized staff will provide you with the best proposal for your business.